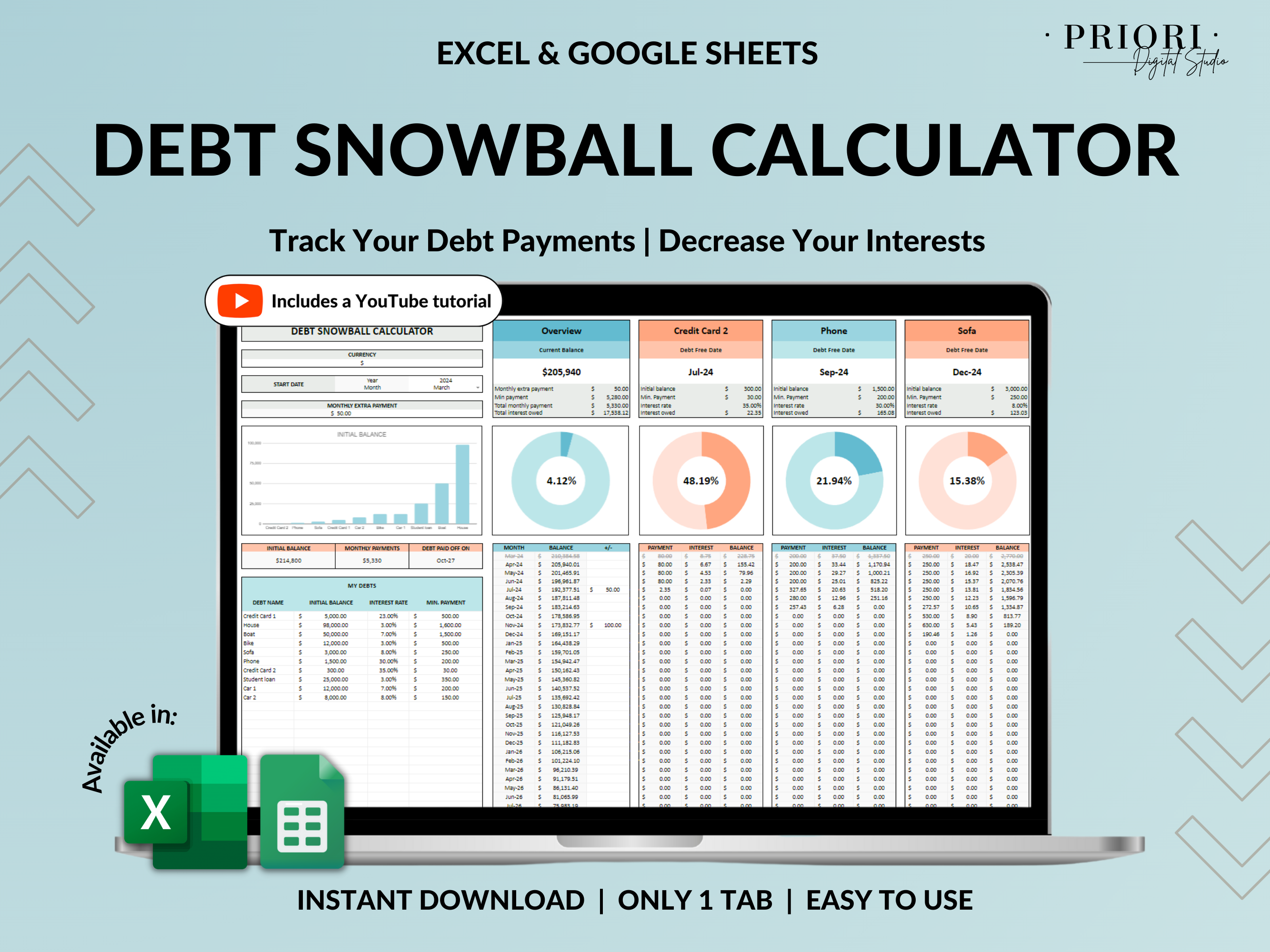

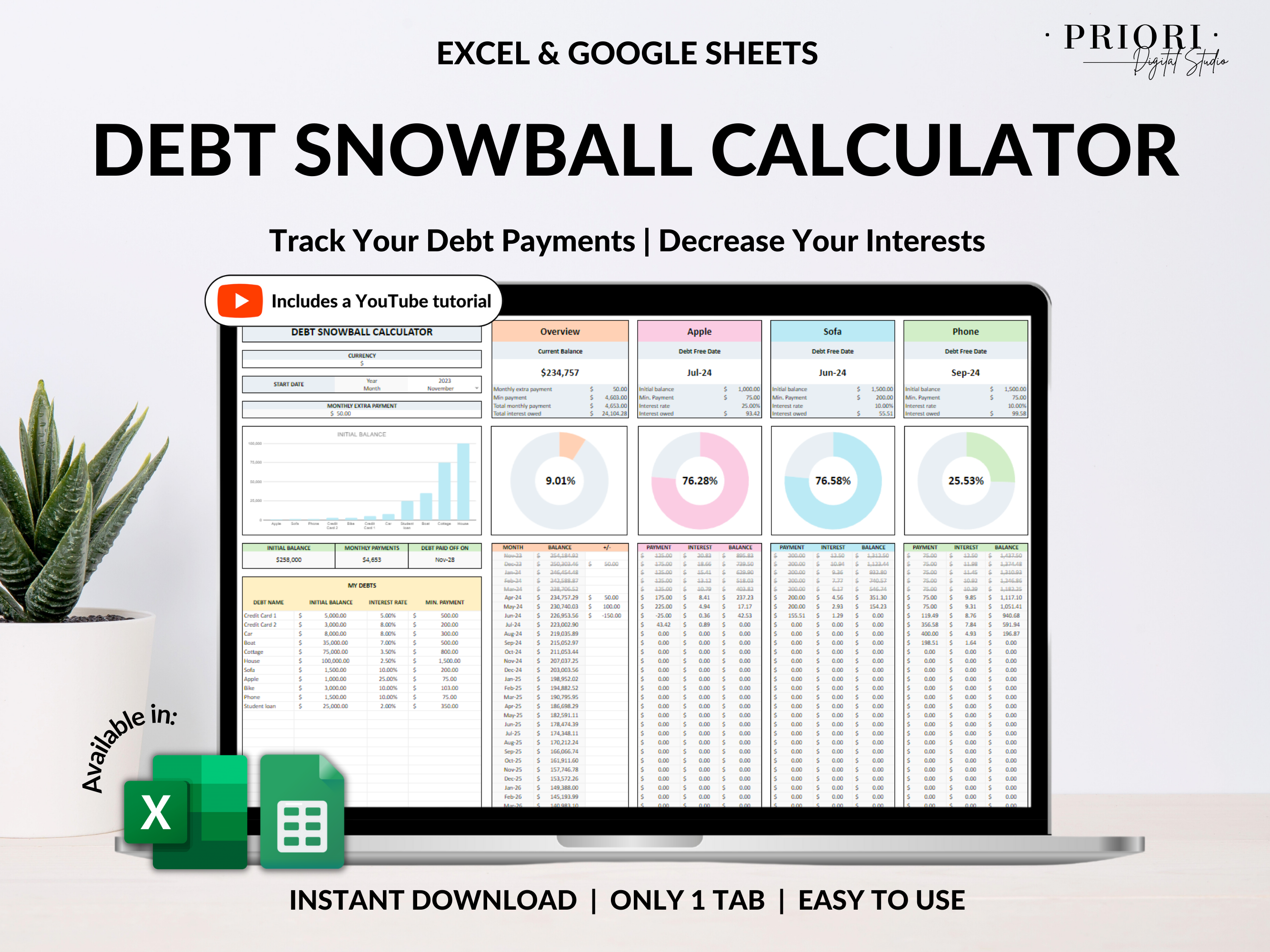

Debt Snowball Calculator

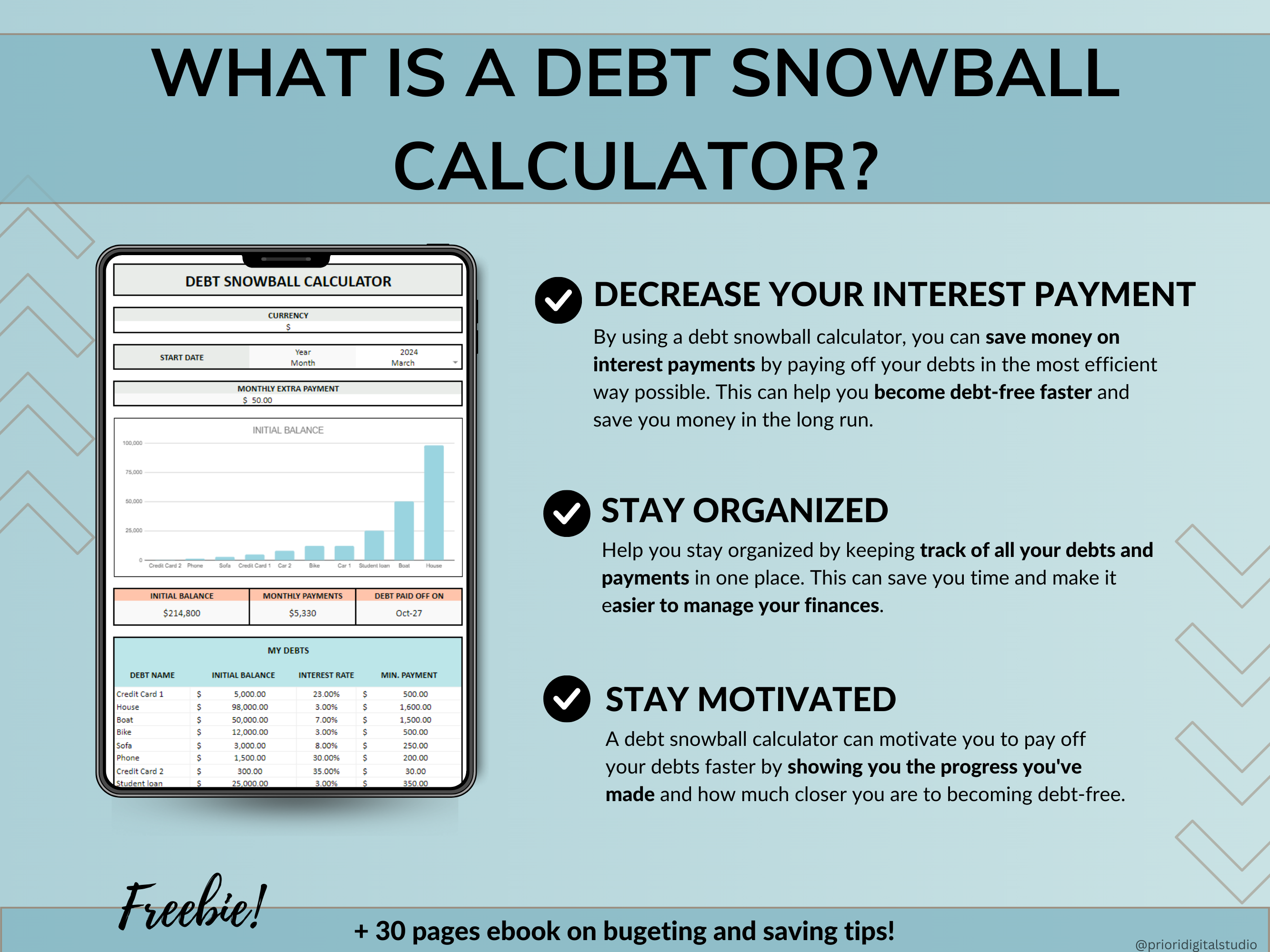

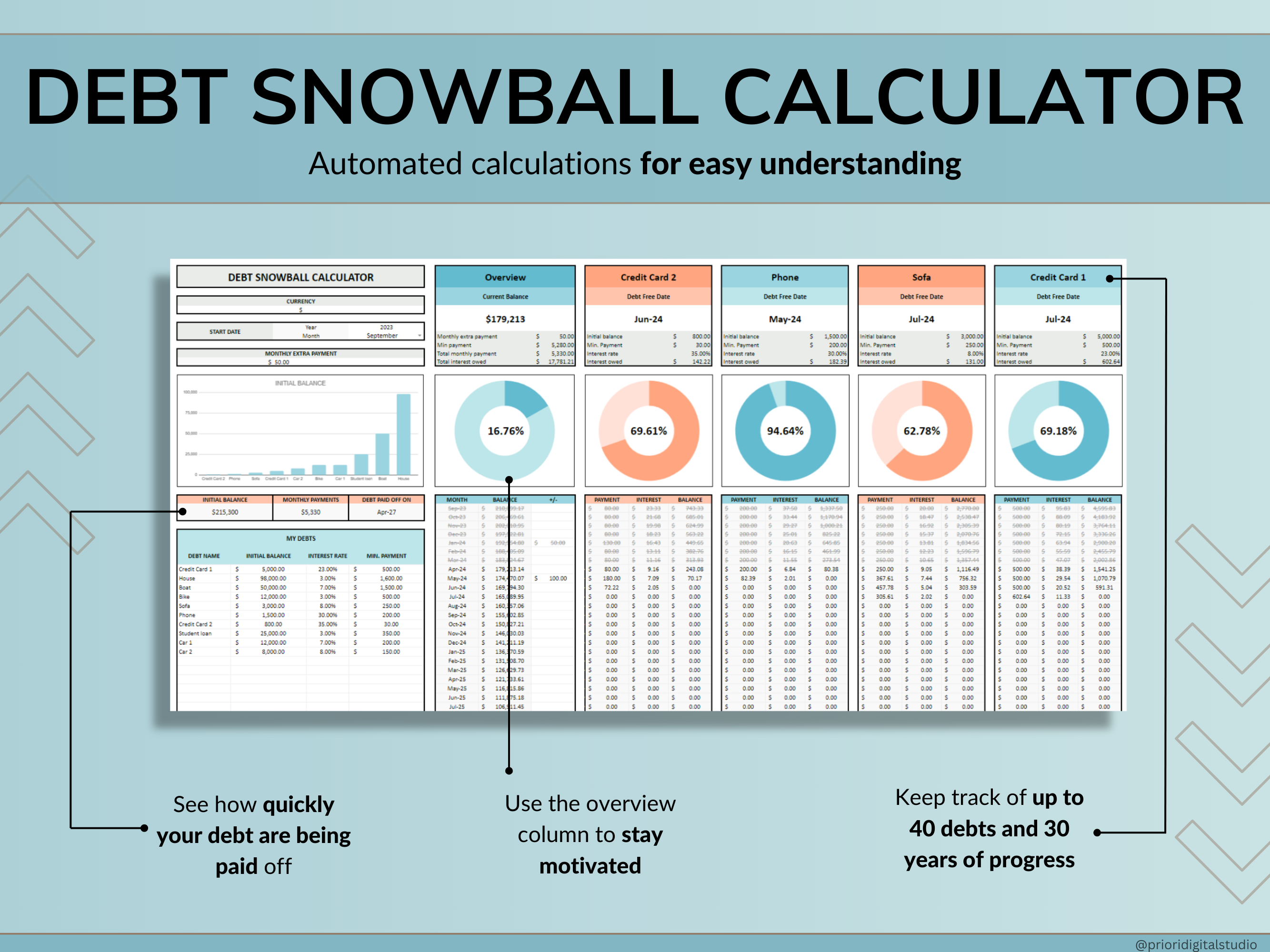

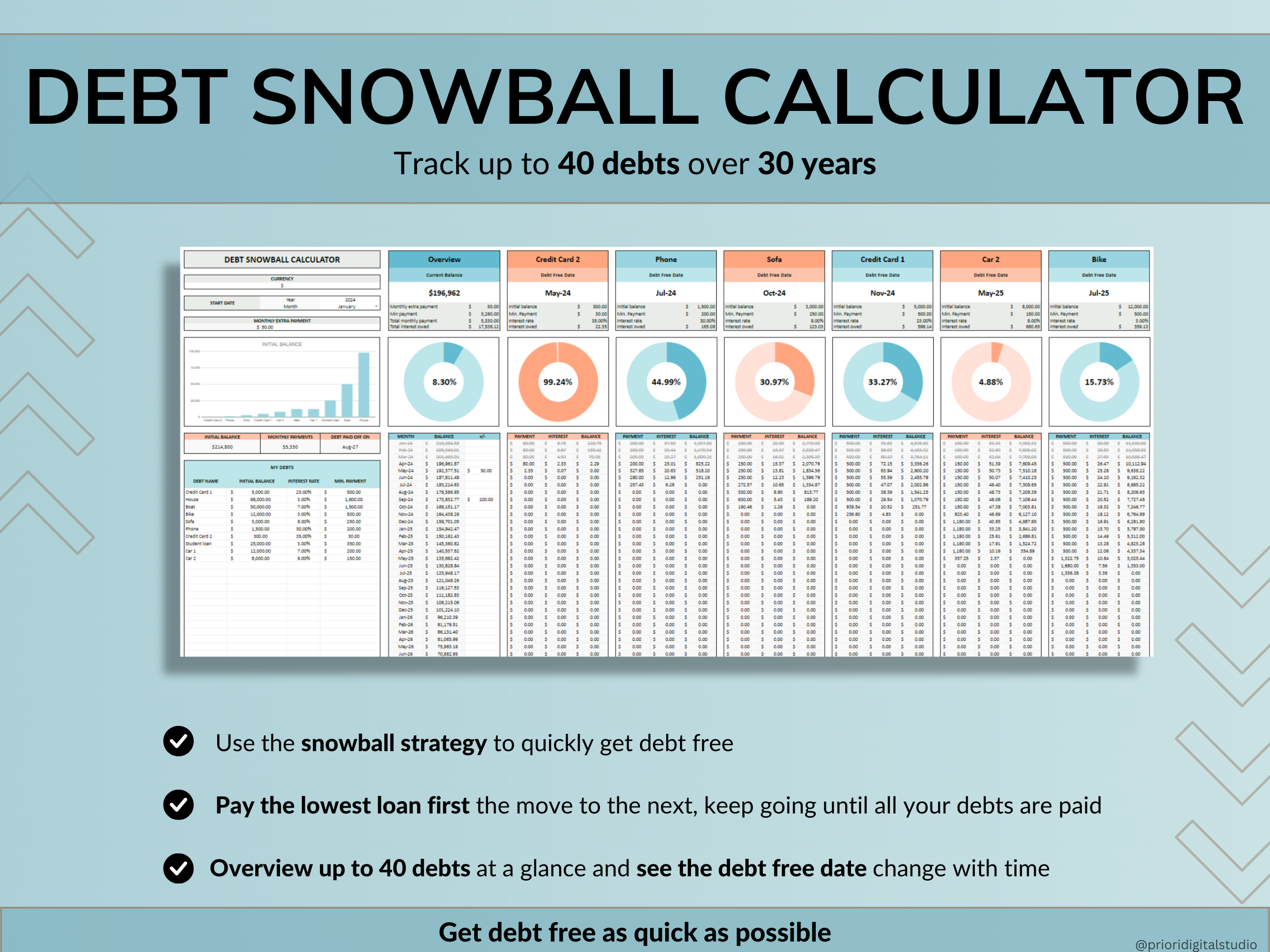

Debt Snowball Calculator Spreadsheet for Google Sheets and Excel is perfect to help you track your debts (student loans, mortgage, credit card debts, car payment, etc.) like a pro. Budget Planner and Financial Planner. Master your finances and easily know where your money goes.

Pairs well with

Available immediately after purchase

No Subscription Required

Trusted by Thousands

Debt Snowball Calculator

Product details

Overview

Debt Snowball Calculator Spreadsheet for Google Sheets and Excel is perfect to help you track your debts (student loans, mortgage, credit card debts, car payment, etc.) like a pro. Budget Planner and Financial Planner. Master your finances and easily know where your money goes.

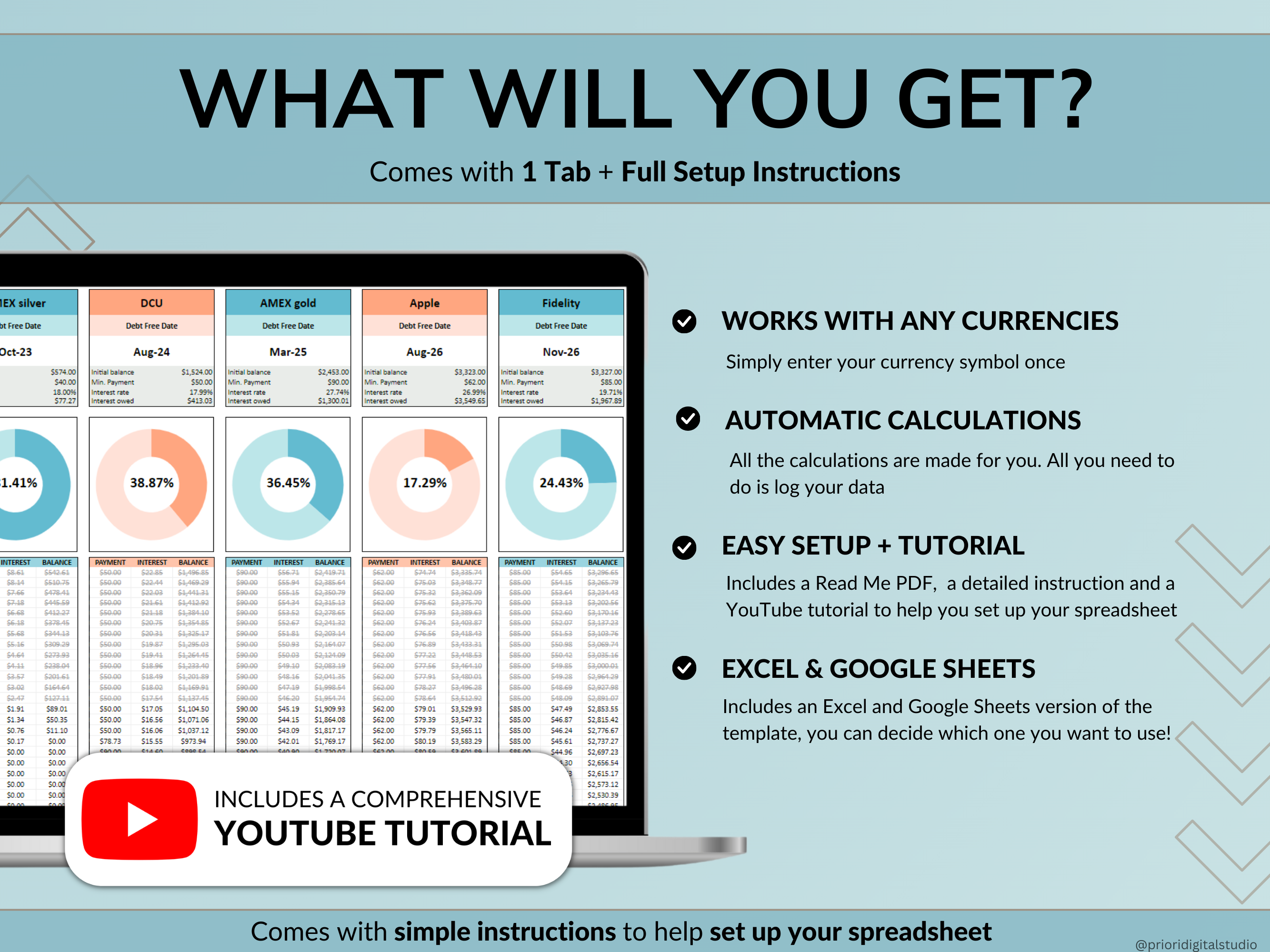

What’s Included

Key Benefits

Who Is This For?

How It Works

Why It’s Different

Delivery & Compatibility

Disclaimer

Copyright notice

FAQs

Please read our FAQs page to find out more.

What formats are your spreadsheets available in?

Our spreadsheets are available in both Excel and Google Sheets formats. If you are a Mac user, our products will not work under Apple Numbers, so we invite you to use Excel for Mac, or the Google Sheets version of our spreadsheets.

Do your spreadsheets come with instructions or support?

Yes. Each spreadsheet purchase includes written instructions and access to a detailed YouTube tutorial. You can find all our tutorials on our YouTube Channel

How do I receive the spreadsheet after purchase?

Upon purchase completion, you'll be directed to a download page. Simply click the designated buttons to download your files. Additionally, you will receive an email with a download link. For further details, you can read our section How to Purchase and Download Digital Products

Can I request a refund if I'm not satisfied with the spreadsheet?

Unfortunately, due to the nature of our products, we do not offer refunds or exchange. You can refer to our Return Policy for further details.

Can I use your spreadsheets for commercial purposes?

No, our spreadsheets are sold for personal use only. However, if you want to use some of our spreadsheets for commercial purposes, then you can find our PLR (Private Label Rights) sectionhere.