Planning your dream wedding should feel exciting, not overwhelming. Yet when the average U.S. wedding costs hover around $33,000–$36,000 (The Knot, 2024), it’s no surprise that budget stress is one of the top concerns for engaged couples. Between hidden fees, unpredictable guest counts, and Pinterest-worthy inspiration, costs can spiral quickly.

The good news: with the right tools and strategy, you can stay in control. This guide breaks down what weddings actually include, how to set a realistic budget, where the money typically goes, and the most common mistakes to avoid. And at the end, you’ll see why our interactive Wedding Planner Spreadsheet can simplify everything.

What weddings include

Before you can budget, you need to know what you’re budgeting for. Weddings aren’t just a one-day event. They often include multiple celebrations, dozens of vendors, and hundreds of hidden details.

Here’s a snapshot of what most weddings typically include:

-

Venue & Catering: Reception space, ceremony site, food, beverages, gratuities, and service fees.

-

Attire: Wedding dress, suit/tux, shoes, jewelry, alterations.

-

Photography & Videography: Engagement shoot, full-day coverage, highlight reel, raw footage.

Entertainment: DJ, band, ceremony musicians, emcee. -

Décor & Flowers: Bouquets, boutonnieres, centerpieces, ceremony arches, linens, candles.

-

Stationery: Save-the-dates, invitations, RSVP cards, programs, menus, thank-you notes.

-

Beauty & Wellness: Hair, makeup, spa treatments, pre-wedding fitness.

-

Transportation: Guest shuttles, getaway car, valet parking.

-

Extras: Favors, signage, lighting, photo booth, guestbook.

-

Marriage License & Officiant Fees

It adds up quickly. That’s why knowing the full scope is the first step to preventing financial surprises.

How to set a realistic wedding budget

The first question most couples ask is: How much should we spend?

The short answer: it depends on your income, savings, and priorities. But here are steps that work for almost everyone:

-

Define Your Total Budget Early.

Sit down with your partner and any contributing family members. Decide on a comfortable total spend before you book a single vendor. -

Know the Averages, but Don’t Feel Tied to Them.

While the national average hovers around $33,000, smaller weddings or destination celebrations can cost half of that. Large-city events with 200+ guests can double it. -

Prioritize Non-Negotiables.

Is photography more important than elaborate flowers? Would you rather splurge on a live band and cut back on favors? Ranking priorities helps you adjust spending categories without guilt. -

Account for Guest Count.

Your guest list drives the majority of costs (food, alcohol, rentals). Cutting 25 guests can save thousands. -

Add a Buffer.

Experts recommend reserving at least 5–10% of your budget for unexpected costs, like vendor overtime or last-minute décor changes.

Expert Insight: “Your wedding budget should reflect your values, not someone else’s Instagram feed,” says Kristen Gall, wedding finance consultant.

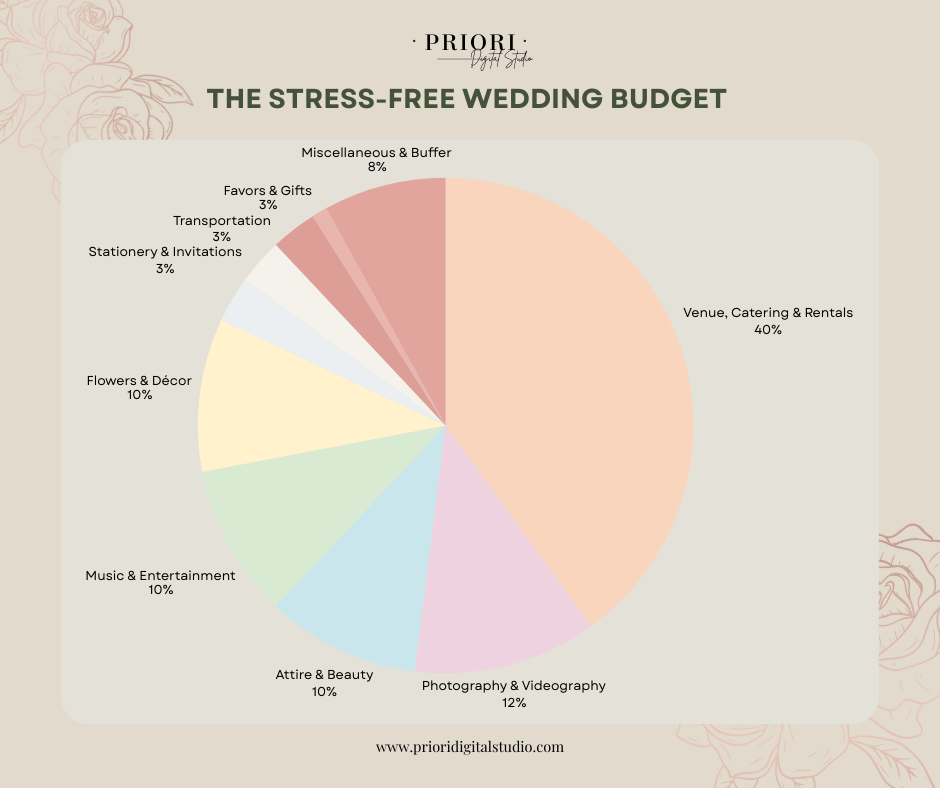

Wedding Budget Breakdown

Once you know your total budget, the next step is breaking it down into categories. This prevents overspending in one area and scrambling in another.

A common breakdown looks like this:

-

Venue, Catering & Rentals: 45–50%

-

Photography & Videography: 10–12%

-

Attire & Beauty: 8–10%

-

Music & Entertainment: 8–10%

-

Flowers & Décor: 8–10%

-

Stationery & Invitations: 2–3%

-

Transportation: 2–3%

-

Favors & Gifts: 2–3%

-

Ceremony Costs (license, officiant): 1–2%

-

Miscellaneous & Buffer: 5–8%

Think of this as a starting point. Your actual percentages may shift depending on what matters most to you.

Budget Exemple

Let’s say your total wedding budget is $30,000. Here’s what it could look like in practice:

-

Venue & Catering: $15,000

-

Photography/Videography: $3,000

-

Attire & Beauty: $2,500

-

Entertainment: $2,500

-

Flowers & Décor: $2,000

-

Stationery: $750

-

Transportation: $750

-

Favors & Gifts: $500

-

Ceremony Costs: $500

-

Miscellaneous/Buffer: $2,500

Suddenly, that $30k doesn’t feel so big, right? That’s why tracking every dollar matters.

Budget pro tips & considerations

Smart couples look beyond the obvious. Here are a few insider tips to stretch your budget:

-

Ask About Service Fees. Venues often tack on 18–22% for gratuity and service. That’s thousands of dollars many couples forget to factor in.

-

Choose Off-Peak Dates. Friday or Sunday weddings, or off-season months (January–March), can save 20–30% on venue costs.

-

Limit Bar Options. Offering beer, wine, and a signature cocktail instead of a full open bar can slash your bill without dampening the fun.

-

Reuse Décor. Ceremony florals can double as reception centerpieces. Bridesmaid bouquets can decorate the cake table.

-

Consider Insurance. Wedding insurance can protect your investment if vendors cancel or unexpected events arise.

-

Negotiate Thoughtfully. Vendors expect some flexibility. Bundling services (like photography + videography) often leads to discounts.

Common Wedding Budget Mistakes to Avoid

Even with the best intentions, couples fall into the same traps. Avoid these mistakes:

-

Ignoring the Guest List Early. Finalizing the guest count late leads to ballooning catering costs.

-

Forgetting Hidden Costs. Taxes, gratuities, delivery fees, and overtime can add 10–15% to your bill.

-

Not Tracking Deposits. With multiple vendors, it’s easy to lose track of what’s been paid vs. what’s due.

-

Over-Splurging on “Inspiration.” Pinterest boards are beautiful but rarely realistic.

-

Skipping a Contingency Fund. Something always costs more than expected.

-

Mixing Personal & Wedding Finances. Keep a separate account to prevent overspending.

-

Relying Solely on Memory. If you’re not logging expenses, you’re already behind.

Why our Budget Spreadsheet is a Game-Changer

The Budget tab inside our wedding planner isn’t just a list of numbers, it’s an interactive tool that auto-calculates every expense against your budget.

Here’s how it works:

-

Set Your Total Budget → Enter your overall spending limit at the top.

-

Break It Down by Category → Venue, catering, attire, flowers, photography, music, and more.

-

Track Real Spending → As you book vendors, input the actual cost. The spreadsheet instantly shows:

-

Remaining budget in each category

-

Overall remaining budget

-

Over/under status with easy-to-read color codes

No more wondering “Did we overspend on flowers?”, the numbers update in real time.

How to Allocate Your Wedding Funds

One of the best parts of this system is that it helps you decide where to put your money based on your priorities.

Here’s a quick guide:

-

50%: Venue, Food, and Drinks (The biggest chunk of your budget)

-

10%: Photography & Videography (Capturing your memories is worth it!)

-

10%: Attire (Dress, suit, accessories, alterations)

-

10%: Entertainment (Band, DJ, ceremony musicians)

-

20%: Everything Else (Décor, invitations, transportation, favors)

And the beauty? You can adjust these percentages in the spreadsheet, and it will instantly recalculate your available funds in each category.

Sneak Peek: Your Budget Dashboard

Imagine opening your laptop and seeing your entire wedding budget at a glance:

-

Remaining funds in big, bold numbers

-

Category-by-category progress bars

-

Automatic over-budget alerts

No complicated formulas. No manual math. Just instant clarity.

Ready to Take the Stress Out of Wedding Budgeting?

Whether you’re 12 months out or just starting to book vendors, the right budgeting tool will save you time, money, and more than a few headaches.

👉 Use our automated wedding budget spreadsheet to track every expense and keep your wedding plans organized from start to finish.

Additional resources

Industry Data & Statistics

Use these to support your mentions of average wedding costs, breakdown percentages, and trends.

-

The Knot Real Weddings Study (2024): The most widely cited source on U.S. wedding costs and budget breakdowns.

-

WeddingWire Newlywed Report: Offers data on how couples spend, guest counts, and priorities.

-

Brides.com Wedding Cost Guide: Another useful breakdown with expert advice.

Budgeting Tools & Calculators

Great to recommend alongside your spreadsheet as alternatives or complements.

-

The Knot Wedding Budgeter: Free online calculator.

-

Mint Budgeting App: For couples who want to manage wedding + personal finances in one app.

-

Zola Wedding Budget Tool: Interactive budget planner with category breakdowns.

Expert Tips & Financial Guidance

These reinforce authority while giving readers extra perspectives.

-

NerdWallet: Wedding Budget Guide: Practical, finance-focused advice.

-

Forbes Advisor: Average Wedding Costs: Updated statistics with financial planning context.

-

Martha Stewart Weddings Budget Tips: Style-focused but includes cost-saving hacks.

Inspiration & Real Weddings

Useful for couples who need both numbers and vision.

-

Green Wedding Shoes Budget-Friendly Weddings: Real examples of weddings on smaller budgets.

-

Offbeat Bride Budget Tips: Alternative approaches for couples looking outside the “traditional” spend.

Insurance & Legal Considerations

Helpful for your “Pro Tips & Considerations” section.

-

WedSafe Wedding Insurance: Leading provider for event coverage.

-

Travelers Wedding Insurance: Another option couples can compare.

-

U.S. Marriage License Requirements: State-by-state guide for license fees and regulations.

Share:

Wedding Planning Checklist for 2026 Brides

How to Choose Your Wedding Venue