Creating a budget that works for you can often feel like a daunting task, especially with so many financial advice sources out there. However, one simple and effective budgeting method that has stood the test of time is the 50/30/20 rule. This rule offers a straightforward framework to manage your finances, save for the future, and achieve your financial goals. Let’s dive into what the 50/30/20 rule entails, how it can help you build a solid budget, and how you can adapt it to fit your unique lifestyle.

What is the 50/30/20 Rule?

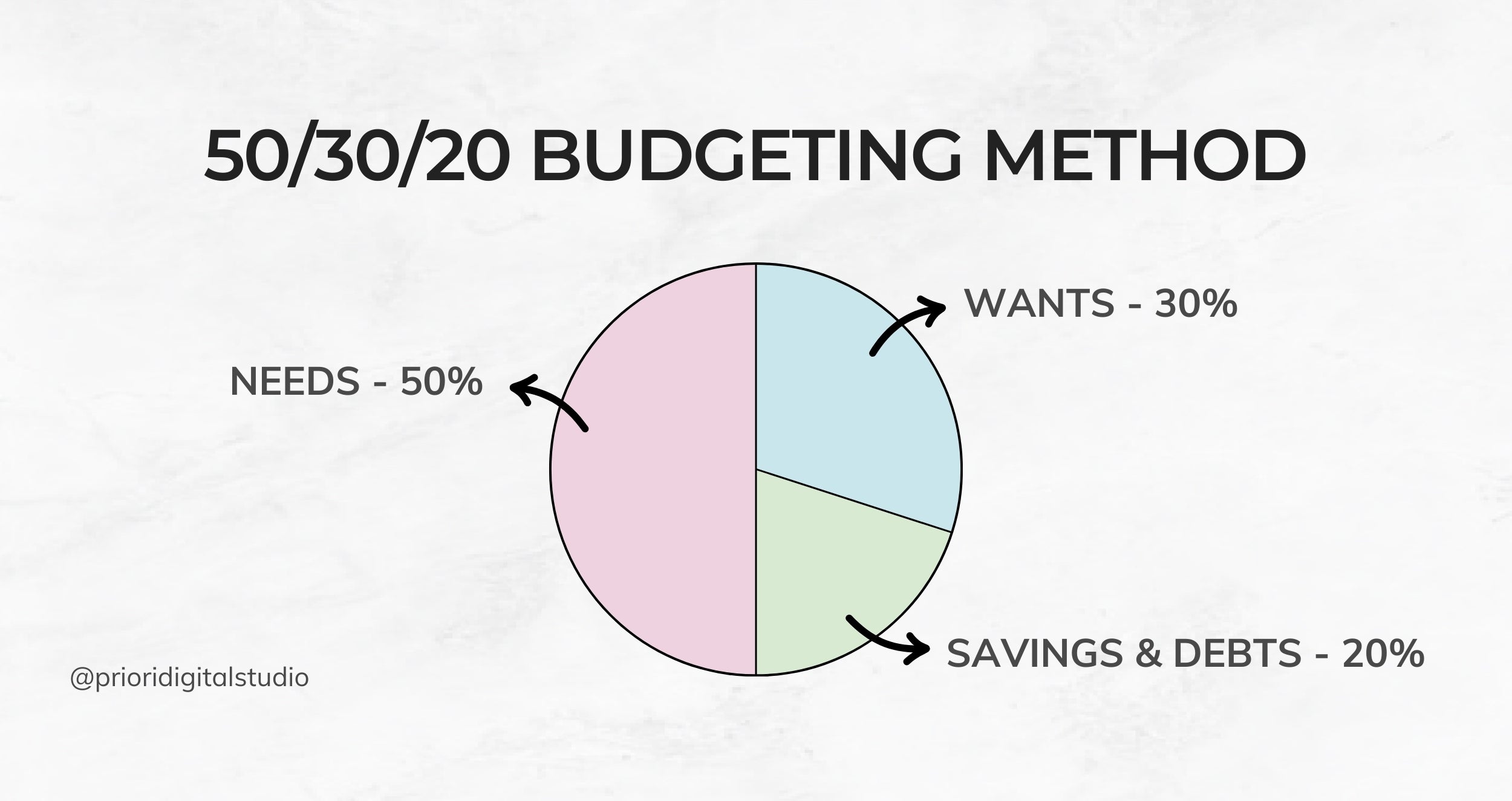

The 50/30/20 rule is a budgeting guideline that divides your after-tax income into three main categories:

- 50% Needs: This portion of your budget should cover essential expenses. These are non-negotiable costs required for your day-to-day living, including rent or mortgage, utilities, groceries, transportation, and insurance. Essentially, these are the expenses you must pay to maintain a basic standard of living.

- 30% Wants: This category encompasses discretionary spending—things you enjoy but don't necessarily need. It includes dining out, entertainment, travel, and other non-essential items that enhance your quality of life. Allocating 30% of your income to wants ensures you can enjoy life without overindulging.

- 20% Savings and Debt Repayment: The final portion is dedicated to savings and debt repayment. This includes contributions to retirement accounts, emergency funds, and paying down debts. Prioritizing this category helps build a financial cushion and reduce financial stress in the long run.

How the 50/30/20 Rule Helps Build a Solid Budget

The 50/30/20 rule provides a clear and balanced approach to budgeting, making it easier to manage your finances effectively. Here’s how it can help you:

- Clarity and Simplicity: With just three main categories, the 50/30/20 rule simplifies budgeting. It’s easy to understand and apply, which helps you stay on track without getting bogged down by complex financial formulas.

- Balanced Spending: By allocating a fixed percentage to needs, wants, and savings, you ensure that you’re not only covering your essentials but also enjoying life and saving for the future. This balance can prevent overspending in any single category and promote a healthier financial lifestyle.

- Flexibility and Adaptability: The 50/30/20 rule provides a framework that can be adjusted based on your personal circumstances. For instance, if you have high living expenses or are working towards paying off significant debt, you might allocate a larger percentage to savings and debt repayment and reduce the proportion for wants.

Adapting the 50/30/20 Rule to Your Lifestyle

While the 50/30/20 rule is a great starting point, it’s essential to recognize that everyone’s financial situation is unique. Here’s how you can adjust the percentages to better fit your lifestyle:

- Higher Savings or Debt Repayment Needs: If you’re focused on aggressive debt repayment or building a robust savings account, consider adjusting your budget to allocate 30% or more towards savings and debt repayment. This might mean reducing the percentage allocated to wants or finding ways to decrease your essential expenses.

- Living in High-Cost Areas: If you live in an area with a high cost of living, your essential expenses might take up more than 50% of your income. In such cases, you might need to reallocate the percentages, perhaps dedicating 60% to needs, 20% to wants, and 20% to savings and debt repayment.

- Adjusting for Income Variability: If your income fluctuates, you might want to use a flexible percentage approach. For instance, during months with higher income, you can put more into savings or debt repayment, while during leaner months, you adjust accordingly.

- Personal Financial Goals: If you have specific financial goals, like saving for a down payment on a house or a major vacation, you might choose to temporarily adjust the percentages. For instance, you could allocate a larger portion of your income towards savings for a defined period.

Concrete Examples of 50/30/20 Budget Allocation

To illustrate how the 50/30/20 rule works in real life, let's look at some concrete examples based on different lifestyles and family situations.

Example 1: Single Professional

- Income: $5,000 per month

- 50% Needs: $2,500

- Rent: $1,500

- Utilities: $200

- Groceries: $300

- Transportation: $500

- 30% Wants: $1,500

- Dining Out: $300

- Entertainment (movies, concerts, etc.): $200

- Travel: $500

- Hobbies: $500

- 20% Savings and Debt Repayment: $1,000

- Emergency Fund: $400

- Retirement Savings: $400

- Credit Card Repayment: $200

Adaptation: If this professional lives in a high-cost city, they might need to adjust their percentages to 60% needs, 20% wants, and 20% savings and debt repayment.

Example 2: Young Family with Two Children

- Income: $7,000 per month

- 50% Needs: $3,500

- Mortgage: $2,000

- Utilities: $300

- Groceries: $600

- Childcare: $600

- 30% Wants: $2,100

- Family Outings: $400

- Dining Out: $300

- Entertainment (subscriptions, etc.): $200

- Vacation Savings: $1,200

- 20% Savings and Debt Repayment: $1,400

- Emergency Fund: $600

- Retirement Savings: $500

- Student Loan Repayment: $300

Adaptation: If the family is focused on paying off a large mortgage, they might prioritize increasing the savings portion to 25% and reducing discretionary spending to 25%.

Example 3: Retired Couple

- Income: $4,000 per month

- 50% Needs: $2,000

- Housing (rent or mortgage): $1,200

- Utilities: $200

- Groceries: $300

- Health Insurance: $300

- 30% Wants: $1,200

- Travel: $600

- Dining Out: $300

- Hobbies (golf, gardening, etc.): $300

- 20% Savings and Debt Repayment: $800

- Additional Savings: $800

Adaptation: For a retired couple, if healthcare costs increase, they might reallocate funds from wants to cover medical expenses or boost savings for unexpected costs.

Conclusion

The 50/30/20 rule is a powerful tool for managing your finances, offering a balanced approach to budgeting that covers needs, allows for discretionary spending, and prioritizes savings and debt repayment. By understanding and applying this rule, you can build a solid financial foundation and achieve your financial goals. Remember, flexibility is key—adapt the rule to fit your personal circumstances and financial objectives to make the most out of your budgeting strategy.

Share:

Planning a Wedding Step by Step: Your Ultimate Guide to a Stress-Free Celebration